Cryptocurrency Exchange Reviews – Honest Fees, Security & Features Guide

When you dive into Cryptocurrency Exchange Reviews, you get a clear look at how each platform works, who it serves, and what risks or perks it brings. Also known as crypto exchange reviews, they help traders cut through hype and pick a service that matches their goals.

One of the first things any reviewer checks is exchange fees, the cost you pay for buying, selling, withdrawing or moving crypto on a platform. Fees directly affect your bottom line, especially if you trade often. Another non‑negotiable factor is security, the set of measures a platform uses to protect user assets from hacks or theft. Strong security builds trust, while weak safeguards can lead to costly losses. Together, these two attributes shape the overall value proposition of any exchange.

Regulation also plays a huge role. A platform that follows local financial laws usually offers clearer dispute processes and better consumer protection. In contrast, unregulated services may promise high rewards but hide hidden risks. Meanwhile, the rise of decentralized exchange, a peer‑to‑peer marketplace that operates without a central authority adds another layer to the decision‑making puzzle. DEXs often provide greater privacy and control, yet they can suffer from low liquidity or complex interfaces. Understanding how these entities interact—fees, security, regulation and DEX mechanics—gives you a solid base for comparison.

Our reviews break each platform down into bite‑size sections: fee structure, security protocols, regulatory status, supported assets, and user experience. We also score customer support, mobile app quality, and any unique features like staking or lending. By laying out the data side by side, you can instantly see where Binance beats Bybit on liquidity, or why NDAX might be a safer choice for Canadian users compared to a lesser‑known local service.

We don’t just list numbers; we explain what they mean for you. For example, a 0.1% taker fee sounds low, but if the exchange charges high withdrawal fees on popular coins, the total cost can climb quickly. That’s why we highlight exchange fees in every review and compare them against real‑world trading scenarios. Security ratings consider factors like two‑factor authentication, cold storage ratios, and past breach history. Regulation checks look at licensing, AML/KYC compliance, and any government enforcement actions.

Who benefits from these reviews? Beginners who need a safe entry point, seasoned traders hunting the lowest fees, institutional players looking for compliance, and anyone curious about the future of decentralized trading. No matter your level, the same core questions apply: How much will I pay? Is my money safe? Can I trust the platform’s legal standing? Our curated collection answers those questions head‑on.

Below you’ll find a hand‑picked set of in‑depth reviews that cover the most talked‑about exchanges of 2025. Each article follows the same rigorous template, so you can quickly scan, compare, and decide which platform fits your strategy best. Let’s get into the details and see which exchange earns your vote.

BitMEX Crypto Exchange Review: Features, Risks, and Who It's Really For

BitMEX is a top-tier crypto derivatives exchange for experienced traders seeking high-leverage Bitcoin trading. With 100x leverage, deep liquidity, and zero hacks, it's unmatched for pros - but not for beginners or U.S. users.

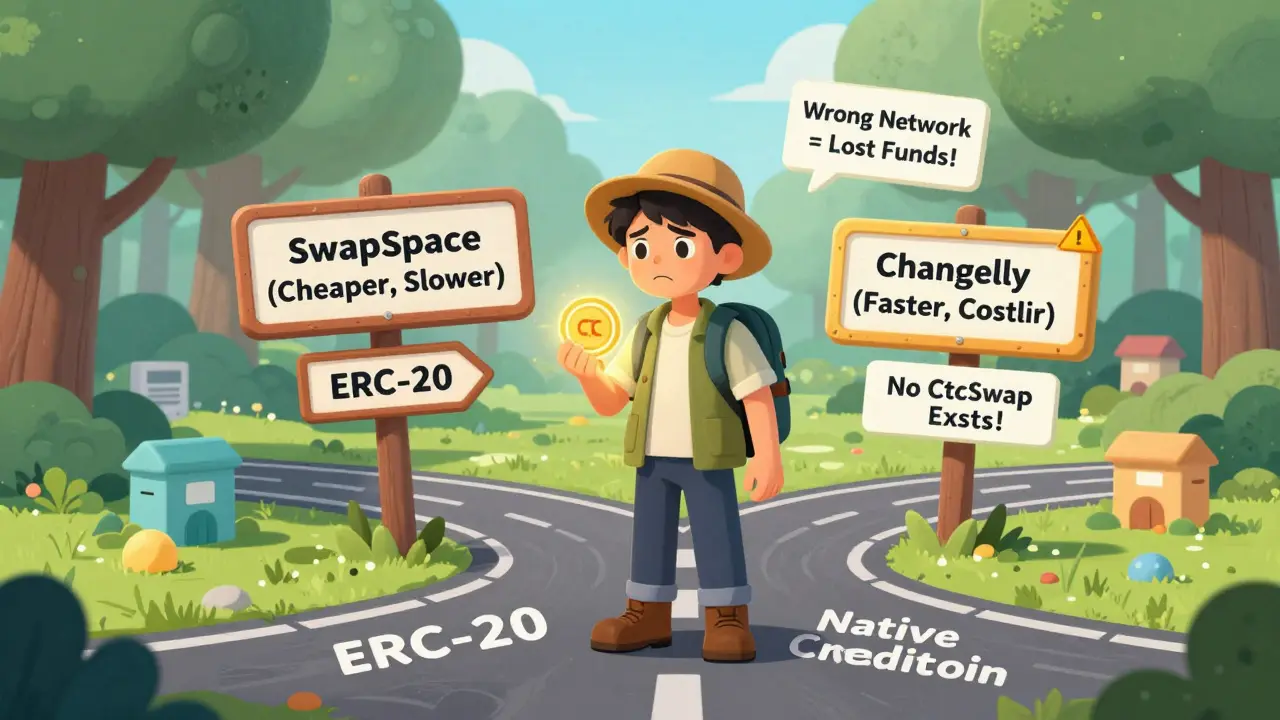

CtcSwap Crypto Exchange Review: How to Swap Creditcoin (CTC) in 2026

CtcSwap isn't a real exchange - it's a term for swapping Creditcoin (CTC) tokens. Learn how to safely trade CTC on SwapSpace and Changelly in 2026, avoid network mistakes, and understand the risks.

Tradekax Crypto Exchange Review: Is It Safe or Just Another Unverified Platform?

Tradekax claims to be a secure crypto exchange, but it has no verified reviews, no security disclosures, and isn't listed on major platforms. Avoid until it proves it's trustworthy.

BTCsquare Crypto Exchange Review: Is It Safe or Just a Ghost Platform?

BTCsquare claims to be a no-KYC crypto exchange with low fees, but it has virtually no trading volume, no mobile app, and no user support. Don't risk your funds on a platform that's effectively dead.

Ring Exchange (Ethereum) Crypto Exchange: Is It Legit or a Scam?

Ring Exchange is not a legitimate Ethereum exchange - it's a scam. No verified reviews, no regulatory registration, and no presence on major crypto platforms. Learn the red flags and where to trade Ethereum safely instead.

DefiPlaza Crypto Exchange Review: A Niche DEX Built to Fight Impermanent Loss

DefiPlaza is a niche DEX built to solve impermanent loss using its CALM algorithm. Migrated from Ethereum to Radix, it offers unique liquidity incentives but carries high risk after a major fund drain. Best for experienced DeFi users.

Spectrum Finance Crypto Exchange Review: Cross-Chain Trading Without Wraps

Spectrum Finance is a non-custodial cross-chain DEX that lets you swap native Cardano and Ergo assets without wrapping. No intermediaries, no bridge risks - just direct trades. Ideal for DeFi users in the Cardano and Ergo ecosystems.

IMOEX Crypto Exchange Review: Is This Platform Legitimate in 2026?

IMOEX is not a legitimate crypto exchange. No reviews, no regulation, no presence on any trusted platform. This is a scam. Learn how fake exchanges operate and where to trade safely in 2026.

KyberSwap Classic (Avalanche) Crypto Exchange Review: What You Need to Know in 2026

KyberSwap Classic (Avalanche) is a no-KYC, non-custodial DEX for swapping AVAX and KNC with low slippage. Small volume, limited pairs, no reviews - but it works for targeted trades.

Crypxie Crypto Exchange Review: Fees, Security, and Real Performance in 2025

Crypxie offers 0.05% trading fees and fast order matching, but lacks regulation, audits, and transparency. Is this low-cost exchange safe in 2025? Find out what users don't tell you.

STON.fi Crypto Exchange Review: Fast, Decentralized Swaps on TON Blockchain

STON.fi is a fast, non-custodial crypto exchange on the TON blockchain offering low-fee swaps, cross-chain trading without bridges, and staking rewards. Perfect for DeFi users who want privacy and speed.

SheepDex Crypto Exchange Review: Is This Decentralized Exchange Worth Your Time?

SheepDex claims to be a decentralized exchange with spot and derivatives trading, but it has no trading volume, no audits, and no users. Don't waste your time or funds on this vaporware project.