DefiPlaza isn’t another copycat decentralized exchange. It was built with one specific goal: to make liquidity provision in DeFi actually profitable. Most DEXs pay trading fees to liquidity providers, but those fees often get wiped out by something called impermanent loss. DefiPlaza’s entire architecture is designed to fix that. If you’ve ever put money into a liquidity pool and watched your returns vanish because prices moved - even slightly - this exchange is worth understanding.

What Makes DefiPlaza Different?

Most decentralized exchanges like Uniswap or SushiSwap use the Constant Product Market Maker (CPMM) model. It’s simple: the product of two token reserves stays constant. But it has a flaw. When the price of one token in a pair changes, liquidity providers lose value compared to just holding the tokens. That’s impermanent loss - and it’s permanent if you withdraw after a big price swing. DefiPlaza replaced that model with something called CALM - Constant Function Automated Liquidity Management. Instead of treating all trades the same, CALM distinguishes between trades that increase impermanent loss and those that reduce it. When a trade moves prices in a way that hurts LPs, the platform adjusts fees and incentives to compensate. When a trade brings prices back toward equilibrium, it rewards the liquidity pool. It’s not magic. It’s math. And it’s been audited and open-sourced. This isn’t theoretical. On Ethereum, DefiPlaza processed $80 million in trades over two years. That’s not a giant number compared to Uniswap’s billions, but it’s real usage from real people trying to make DeFi work better.It Moved From Ethereum to Radix - And Why That Matters

DefiPlaza started on Ethereum. It was marketed as the cheapest DEX there, with ultra-low gas fees. But Ethereum’s congestion and high costs made sustainable liquidity provision nearly impossible. In 2024, the team made a bold move: they migrated entirely to the Radix network. Radix was designed for DeFi from the ground up. It uses a consensus mechanism called Tempo, which allows for near-instant finality and near-zero fees. That’s critical for DefiPlaza’s model. CALM needs frequent, low-cost adjustments to work. On Ethereum, those adjustments were too expensive. On Radix, they’re seamless. Today, DefiPlaza supports 37 cryptocurrencies and one stablecoin (XUSDC). All trading pairs are native to Radix - no fiat, no Bitcoin or Ethereum direct swaps. You need XRD, the Radix native token, to pay for gas. If you’re used to swapping ETH for USDT on Uniswap, this feels limiting. But if you’re focused on sustainable yield, it’s a strategic narrowing.The Security Disaster That Changed Everything

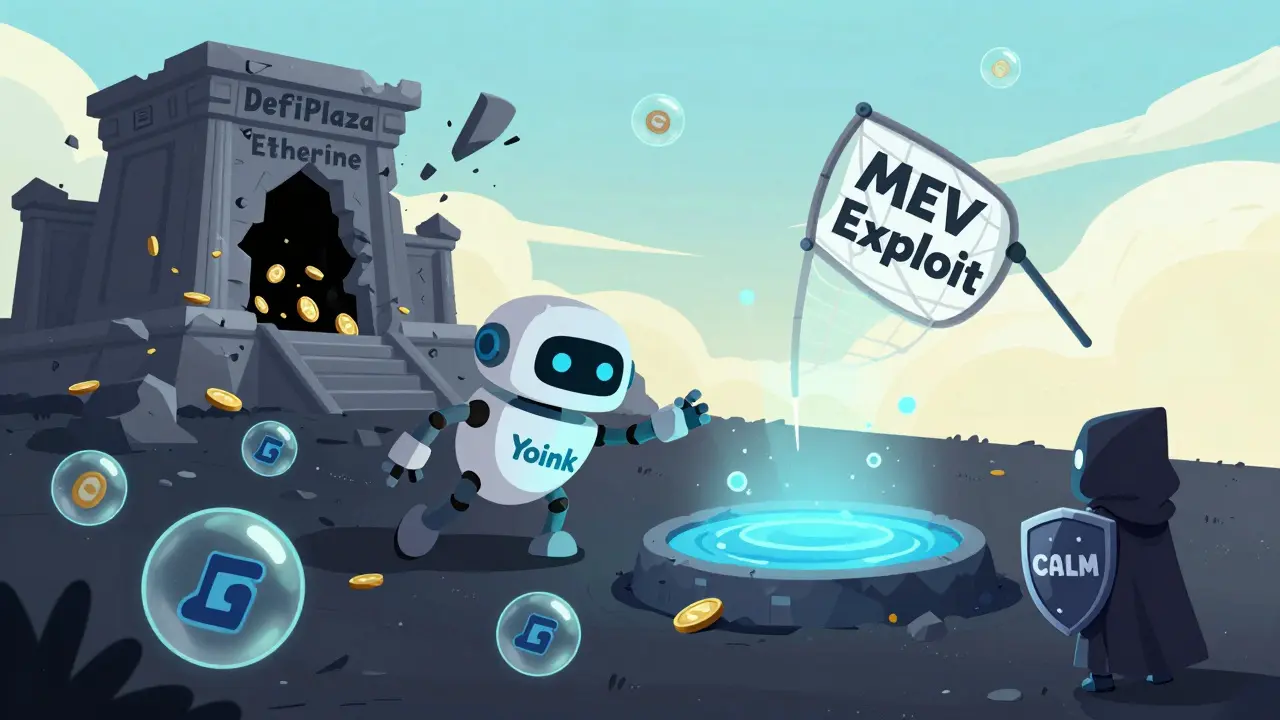

DefiPlaza’s biggest setback came in early 2025. An attacker drained all liquidity from the Ethereum version of the platform. Over $1.2 million in user funds vanished. The exploit didn’t target a smart contract bug. It used MEV (Maximal Extractable Value) - a legal but predatory practice where bots watch the mempool and front-run transactions. Here’s what happened: The attacker sent a transaction to drain the pool. A bot named "Yoink" paid a Lido validator 62.5 ETH - roughly $240,000 at the time - to prioritize its own transaction and steal the tokens first. When DefiPlaza’s team contacted Yoink, they returned the stolen tokens within 30 minutes. But only about 10% of the total stolen funds were recoverable. The rest were sold or moved irreversibly. This wasn’t a hack. It was a system failure. DefiPlaza didn’t have MEV protection. It didn’t have a way to pause or delay large withdrawals. And users lost everything. The Ethereum version was shut down. All future development moved to Radix. The lesson? Even the most innovative DeFi projects can be destroyed by systemic vulnerabilities outside their control. Trust is fragile.

What You Can Do on DefiPlaza Today

If you’re on Radix, here’s what’s live:- Trading: Swap XRD, XUSDC, XWBTC, and other Radix-native tokens. The interface is clean, similar to Uniswap V3.

- Liquidity Provision: Deposit tokens into pools. You get an NFT representing your share. Unlike other DEXs, your returns are adjusted by CALM to offset impermanent loss.

- LaunchPlaza: A launchpad for new Radix tokens. Founders can deploy tokens for free, with built-in burning, staking, and editing tools.

- Bridge: Move DFP2 tokens between Ethereum and Radix. This was critical for users who held assets on the old network.

Who Is This For?

DefiPlaza isn’t for beginners. If you’re new to crypto, stick with centralized exchanges. This is for people who understand liquidity pools, know what impermanent loss is, and are tired of losing money just for providing liquidity. It’s also for developers and builders in the Radix ecosystem. LaunchPlaza is one of the few truly free token launch tools available. No upfront fees. No revenue share. Just deploy and go. If you’re a liquidity provider who’s been burned by other DEXs, DefiPlaza offers a real alternative. The CALM algorithm isn’t perfect, but it’s the only one actively trying to solve the core problem that makes DeFi yield unattractive.What’s Next for DefiPlaza?

The roadmap is focused, not flashy:- Expand CALM to multi-token pools - not just two-token pairs.

- Launch a dedicated stablecoin exchange using bonding curves to reduce slippage.

- Add WalletConnect support so users can connect Phantom, Rabby, or mobile wallets - not just MetaMask.

- Improve documentation and educational content to help new LPs understand how CALM affects their returns.

The Verdict: Innovative, But Risky

DefiPlaza is a bold experiment. It’s not the biggest DEX. It’s not the most popular. But it’s one of the few that’s directly tackling the biggest flaw in DeFi liquidity. The CALM algorithm works. Data from Radix shows LPs on DefiPlaza are earning more net returns than on comparable pools elsewhere. That’s rare. But the Ethereum exploit looms large. Losing $1.2 million isn’t a minor hiccup. It’s a scar. Until DefiPlaza proves it can operate securely at scale - and until users feel confident their funds won’t vanish again - adoption will stay low. If you’re comfortable with high-risk, high-reward DeFi, and you believe in the Radix ecosystem, DefiPlaza is worth testing with small amounts. Don’t put in more than you can afford to lose. But if you’re looking for a DEX that actually tries to fix DeFi’s broken incentives - this is one of the few that does.Key Metrics at a Glance

| Feature | Detail |

|---|---|

| Exchange Type | Decentralized (DEX) |

| Blockchain | Radix (primary), Ethereum (legacy) |

| AMM Model | CALM (Constant Function Automated Liquidity Management) |

| Trading Pairs | 37 cryptocurrencies, 1 stablecoin (XUSDC) |

| 24h Trading Volume | $5,214.93 |

| Market Rank | #272 globally |

| Top Trading Pair | XRD/DFP2 ($1,290.11 24h volume) |

| Wallet Support | MetaMask, Radix Wallet (WalletConnect coming) |

| Fees | 0.1% per trade, no gas fees on Radix |

| Security Status | Audited, open-source. Ethereum version compromised. |

Frequently Asked Questions

Is DefiPlaza safe to use?

DefiPlaza’s Radix version is audited and open-source, with no known exploits since the migration. But the Ethereum version was completely drained in a major MEV attack, and user funds were lost. Only use the Radix version. Never deposit more than you can afford to lose.

How does CALM reduce impermanent loss?

CALM tracks how each trade affects the liquidity pool. If a trade increases impermanent loss, the system adjusts fees to compensate LPs. If a trade reduces it, the pool is rewarded. This dynamic adjustment means LPs earn more net returns than on traditional AMMs, even when prices swing.

Can I trade Bitcoin or Ethereum on DefiPlaza?

Not directly. DefiPlaza only supports Radix-native tokens. You can bridge DFP2 (the old Ethereum token) to Radix, but you can’t swap BTC or ETH for XRD directly. Use a centralized exchange or bridge like Radix’s official bridge first.

Do I need XRD to use DefiPlaza?

Yes. XRD is the native token of the Radix network and is required to pay for transaction fees. You’ll also need it to participate in LaunchPlaza or stake your LP NFTs for additional rewards.

Is DefiPlaza better than Uniswap?

For casual traders? No. Uniswap supports thousands of tokens, has higher liquidity, and is easier to use. For liquidity providers who care about net returns? DefiPlaza’s CALM algorithm gives you a real edge. If you’re serious about DeFi yield and understand the risks, DefiPlaza offers something Uniswap doesn’t: a system designed to protect your capital.

15 Comments

Write a comment

More Articles

Corgidoge (CORGI) Airdrop Details 2025: How to Claim, Referral Rewards & Risks

Detailed guide on Corgidoge (CORGI) airdrop: how to claim, referral rewards, risk assessment, and FAQs for 2025.

Tony Loneman

January 19, 2026 AT 18:50This CALM thing is just a fancy way of saying they’re trying to outsmart the market with math while ignoring the fact that DeFi is a casino where the house always wins. MEV bots didn’t steal from DefiPlaza-they exposed how fragile these ‘innovative’ systems really are. You can’t engineer trust. You can’t code away human greed. This is just another pyramid scheme with a whitepaper.