If you're looking for a crypto exchange that doesn't ask for ID, BTCsquare might pop up in your search. But here’s the truth: BTCsquare isn’t a trading platform you want to use - not because it’s shady, but because it’s practically dead.

What BTCsquare Actually Is (And Isn’t)

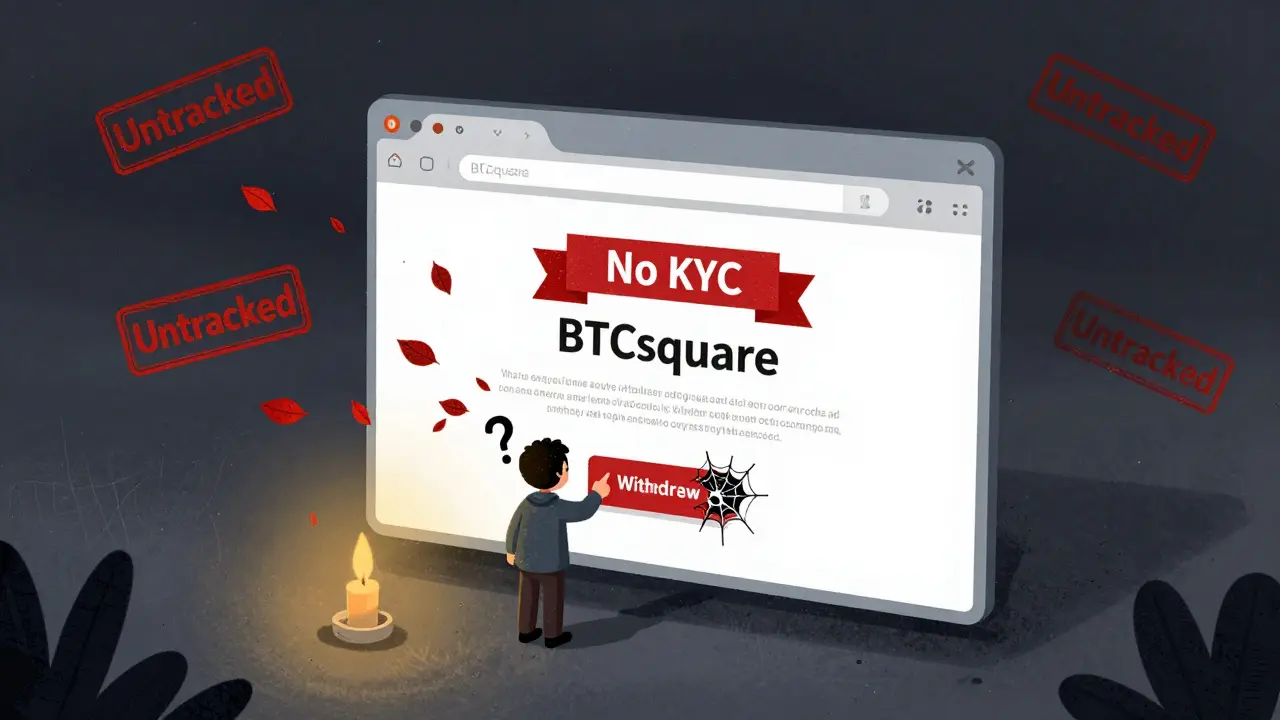

BTCsquare launched in 2018 and claims to be a no-KYC crypto exchange based in Seychelles. That means you can trade without handing over your passport or utility bill. Sounds appealing, right? Especially if you value privacy. But here’s the catch: no one is trading on it. According to CoinMarketCap’s last update in October 2025, BTCsquare is listed as an “Untracked Listing.” That’s not a glitch. It’s a red flag. CoinMarketCap only stops tracking exchanges when trading volume falls below a threshold - and BTCsquare’s volume has been near zero for years. Back in 2020, it was averaging $2,300 in daily trades. Today? No data. That’s because there’s no activity to measure. Most major exchanges like Binance or Coinbase move billions in volume every day. BTCsquare moves less than $3,000. That’s not a startup struggling - that’s a platform that’s already lost.The No-KYC Promise: A Double-Edged Sword

The only thing BTCsquare does well is offer anonymity. No ID. No proof of address. Just log in and trade. That’s rare these days. Even privacy-focused platforms like LocalBitcoins now require some level of verification in many countries due to regulatory pressure. But anonymity without liquidity is useless. Imagine walking into a grocery store where only three people shop. You want to sell your bananas. Who are you selling to? The same three people? What if they don’t want bananas today? You’re stuck. That’s BTCsquare. If you try to sell even a small amount of Bitcoin, you might not find a buyer. Or worse - you’ll get a terrible price because there’s no competition. And while no-KYC sounds like a win, it’s also a warning sign. Legitimate exchanges in regulated markets (like Coinbase or Kraken) have licenses, insurance, and audit trails. BTCsquare has none of that. It’s operating in a legal gray zone with no oversight. If something goes wrong - a hack, a withdrawal delay, a site crash - you have zero recourse.PLURA Token: The Fee Trick That Doesn’t Work

BTCsquare says holding its native token, PLURA, can reduce trading fees to “almost zero.” Sounds great. But here’s the problem: no one’s using it. There’s no public breakdown of fee structures. No examples of how much you’d pay with or without PLURA. And since trading volume is nonexistent, no one’s actually testing this claim. It’s marketing fluff with no proof. Compare that to Binance, where holding BNB clearly reduces fees by 25% - and you can see millions of users doing it every day. With BTCsquare, the PLURA token is like a discount coupon for a store that’s closed.

No Mobile App, No Support, No Community

BTCsquare is a web-only platform. No iOS or Android app. That’s fine if you only trade from a laptop. But in 2026, that’s a major disadvantage. Most traders check prices on their phones. Set alerts. Quick trades during volatility. BTCsquare doesn’t let you do any of that. And there’s no customer support documentation. No live chat. No email response times. No help center. Not even a FAQ page that’s been updated in the last five years. The community? Nonexistent. No Reddit threads. No Telegram groups. No Trustpilot reviews. Just one single user review on Cryptogeek’s site - and no details about what happened. If you have a problem - say, your withdrawal got stuck - you’re on your own. And with no public track record of support, you can’t even guess if they’ll respond.Security Claims That Don’t Add Up

BTCsquare says it stores 98% of funds in cold storage with multisignature wallets. That’s a standard claim. Every exchange says that. But without third-party audits, proof of reserves, or transparency reports, it’s just words. In 2025, the bar for trust isn’t just “we say we’re secure.” It’s “here’s our proof.” Bitcoin exchanges like Bitstamp publish monthly attestations from accounting firms. BTCsquare? Nothing. Zero transparency. And with trading volume this low, it’s unlikely they even have enough funds to justify cold storage. If they’re not moving assets, why bother securing them? The real risk here isn’t a hack - it’s that the platform just shuts down tomorrow and takes your coins with it.Why Experts Ignore BTCsquare

Look at any “Best Crypto Exchanges 2025” list. CryptoPotato. Koinly. CoinGecko. CoinMarketCap’s own rankings. None of them mention BTCsquare. Not once. Why? Because they don’t consider it a real option. These guides cover platforms with real users, real volume, and real regulatory compliance. BTCsquare meets none of those criteria. Even Cryptowisser, which reviewed BTCsquare back in 2019, warned: “There is a risk that this exchange will have to shut down in the near future.” That was six years ago. And here we are - still waiting. Not because it’s still alive. But because no one even cares enough to shut it down properly.

Who Should Use BTCsquare? (Spoiler: Almost No One)

The only person who might consider BTCsquare is someone who:- Needs absolute anonymity and refuses to use any KYC exchange

- Has less than $50 to trade

- Is okay with never withdrawing their funds

- Is fine with zero customer support

- Wants to test a platform that’s likely to vanish

The Bigger Picture: Why Low-Volume Exchanges Die

The crypto exchange market is consolidating. In 2024, over $10 trillion traded across all exchanges. The top 10 platforms handled 95% of it. The rest? Hundreds of tiny exchanges like BTCsquare, slowly fading into irrelevance. They don’t die because they’re bad. They die because no one uses them. And without users, there’s no liquidity. Without liquidity, there’s no traders. Without traders, there’s no revenue. Without revenue, there’s no maintenance. And then - silence. BTCsquare isn’t a hidden gem. It’s a graveyard. And the tombstone says: “Here lies a platform that promised privacy but delivered nothing.”What to Do Instead

If you want no-KYC trading, look at platforms that actually have volume:- LocalBitcoins - Still has active peer-to-peer trading, even with some KYC requirements.

- Bitfinex - Offers non-KYC trading for certain assets with decent liquidity.

- MEXC - No KYC for basic trading, supports 1,000+ coins, and has real volume.

Is BTCsquare a scam?

BTCsquare isn’t a scam in the traditional sense - it’s not stealing funds outright. But it’s a failed platform with no users, no volume, and no future. If you deposit money, you’re not investing - you’re gambling that it won’t vanish overnight. That’s riskier than any scam.

Can I withdraw my crypto from BTCsquare?

Technically, yes. But there’s no public record of anyone successfully withdrawing in the last five years. With zero trading volume and no customer support, withdrawals are unreliable. Many users report delays, failed transactions, or no response from support. Treat any deposit as potentially lost.

Does BTCsquare have a mobile app?

No. BTCsquare is only accessible through a web browser. There is no iOS or Android app. This makes it nearly impossible to trade on the go, monitor prices, or react to market changes quickly - which is a major disadvantage in crypto trading.

Is PLURA token worth holding?

No. PLURA has no real utility. There’s no proof that holding it lowers fees, no trading data to verify its value, and no exchanges where you can sell it. It’s a token with no market, no demand, and no future. Holding it is like owning a coupon for a restaurant that closed years ago.

Why doesn’t CoinMarketCap track BTCsquare anymore?

CoinMarketCap only tracks exchanges with sufficient trading volume to generate reliable data. BTCsquare’s volume has been below the threshold for years - likely under $1,000 daily. When volume drops this low, exchanges are labeled “Untracked” because their data is meaningless. It’s not a ranking issue - it’s a survival issue.

Are there safer no-KYC exchanges?

Yes. MEXC, Bitfinex, and LocalBitcoins offer limited no-KYC trading with real volume, active users, and better security. They’re not perfect, but they’re alive. BTCsquare is not. If you need privacy, choose an exchange that still has people trading on it.

17 Comments

Write a comment

More Articles

RACA x BSC Metamon Game Airdrop: How It Worked and What You Missed

The RACA x BSC Metamon airdrop rewarded early players with tokens and Potion NFTs in 2022. Learn how it worked, why some missed out, and what the rewards were really worth.

What is Wicrypt (WNT) Crypto Coin? A Practical Guide to the Decentralized WiFi Network

Wicrypt (WNT) is a crypto project that lets you earn tokens by sharing your internet connection through a physical hotspot device. It’s designed for areas with poor internet access and has real-world deployments in Nigeria.

Mark Ganim

January 29, 2026 AT 23:56So BTCsquare is the crypto equivalent of a ghost town where the saloon doors still creak… but nobody’s left to drink?

It’s not a scam-it’s a monument to hubris. A platform built on the altar of ‘privacy at all costs’… and then forgotten by the very people it tried to serve.

Privacy without liquidity is just solitude with a wallet.

And PLURA? That’s not a token-it’s a funeral wreath for a dead idea.

They didn’t get hacked. They got ignored.

And in crypto? Being ignored is the quietest, most devastating death there is.